Modelshop is the fastest way to automate custom AI risk decisions across the customer lifecycle. Join me as I create...

Read MoreI’m fascinated with developments in codeless platforms and Large Language Models (LLMs) as they make inroads towards replacing traditional coding....

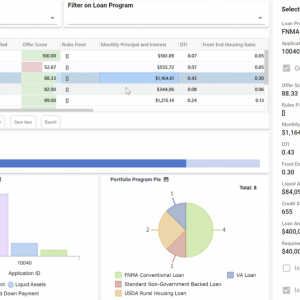

Read MoreThe first blog in this series highlights how credit automation is changing the way lenders make credit decisions. In this...

Read MoreIn my last post, I outlined an evolution of credit origination due to a shift in demographics, the economy and...

Read MoreChanges in demographics, the economy and technology are forcing credit providers to raise the bar on how they originate credit....

Read MoreThere’s a lot of buzz around AI in banking. It’s fun, edgy and brainy. Emerging vendors claim all forms of AI...

Read MoreWhen evaluating a loan application, the most important thing a lender must do is verify the applicant’s income. By integrating...

Read MoreAt a time when automation and big data are at an all time high, the speed with which you can...

Read MoreLenders know that they must digitize origination if they want to remain competitive. Completing an online application through funding in...

Read MoreI had the privilege of working with a brilliant team of data scientists and engineers who put a big dent...

Read MoreCategories

Stay Connected!

Get The ModelShop newsletter delivered each week.