Automate any decision. Without coding.

Modelshop powers more than credit. Select partners have white-labeled our platform to power no-code decision engines in multiple industries.

Watch a DemoModelshop powers more than credit. Select partners have white-labeled our platform to power no-code decision engines in multiple industries.

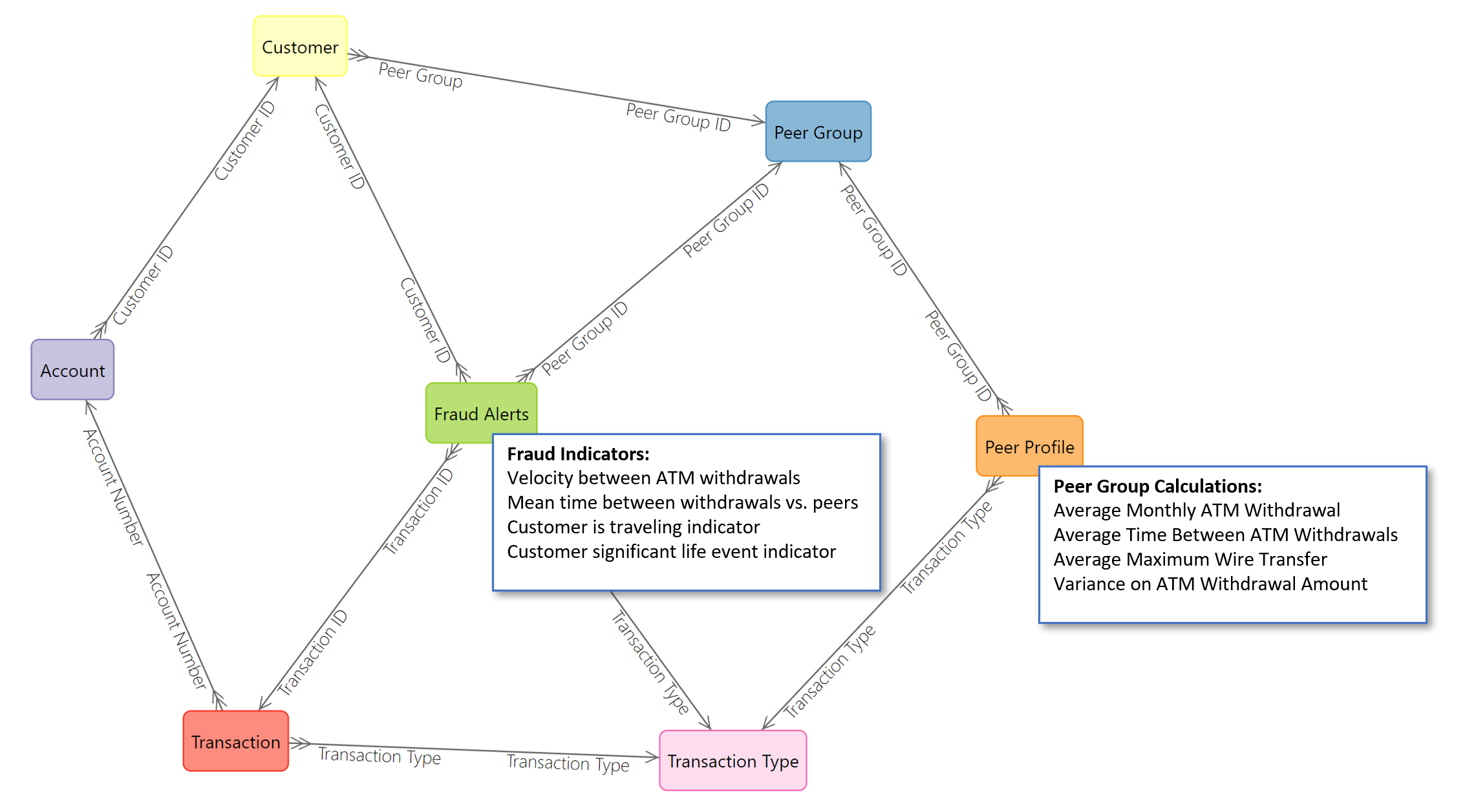

Watch a DemoLife would be easier if data was simple tables, but modern decision solutions require more complex data structures.

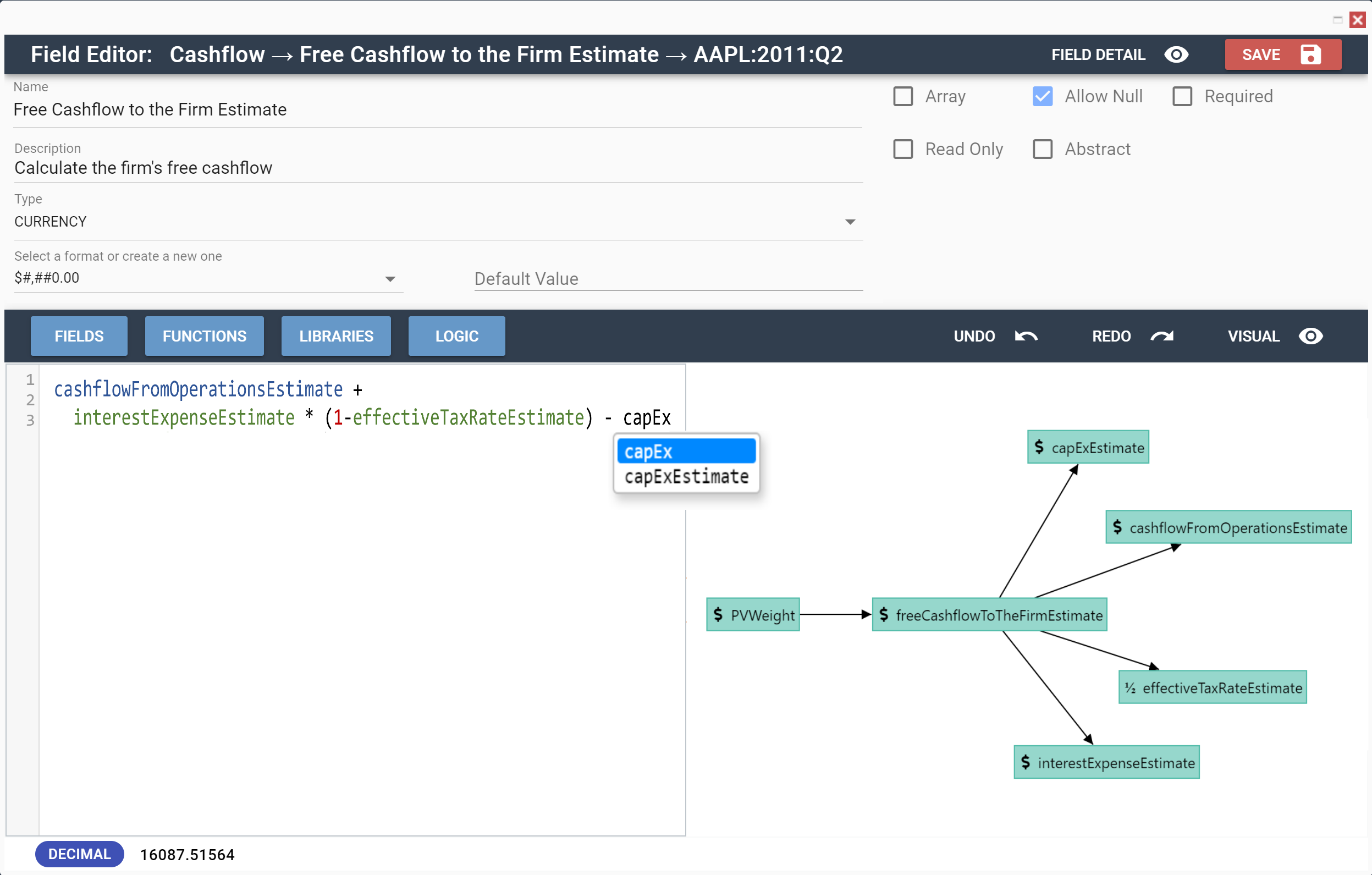

Real models require real logic, and point-and-click solutions won't do. Modelshop uses a powerful business syntax based on Apache Groovy that feels comfortable for spreadsheet users but adds the power of advanced logic.

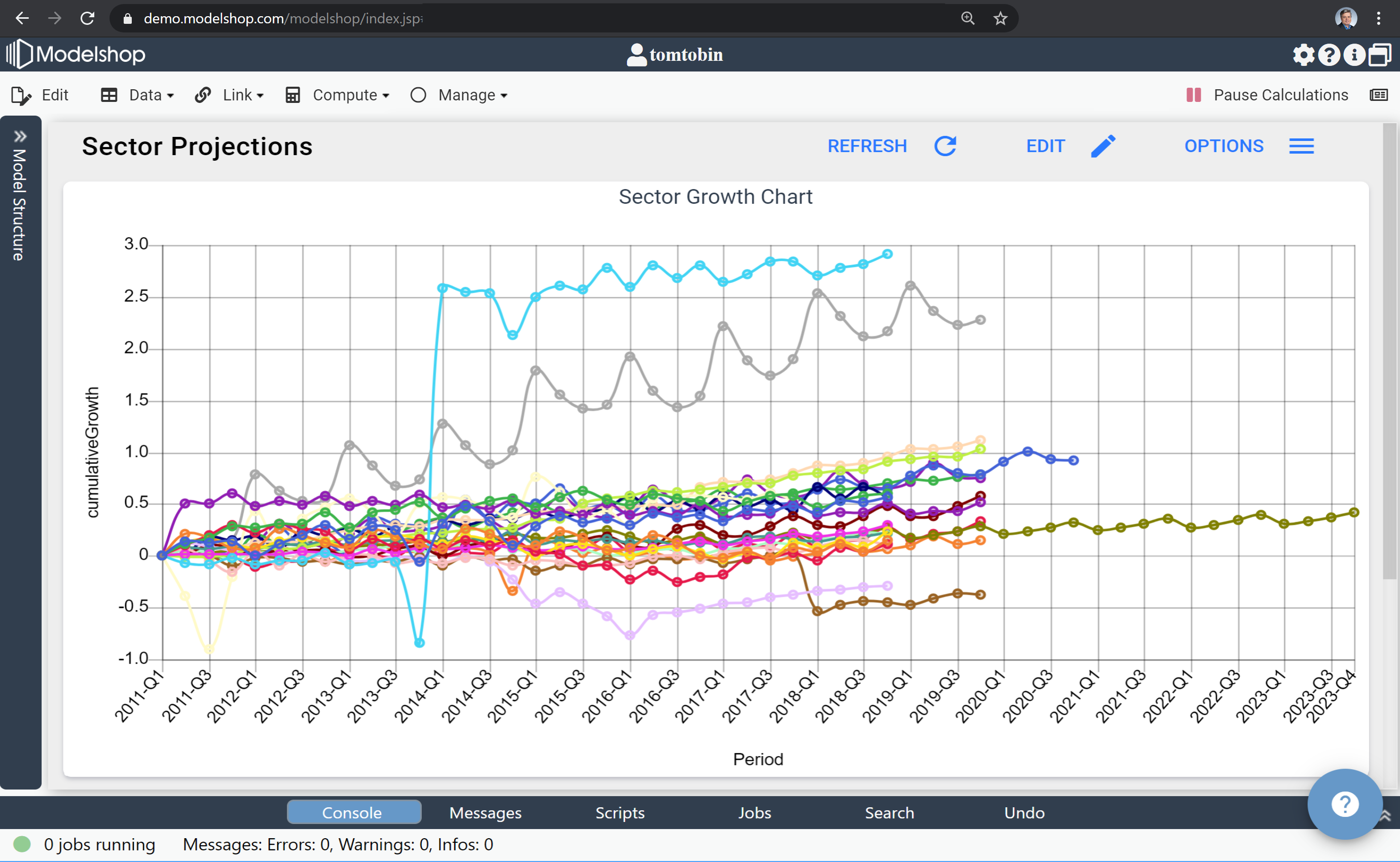

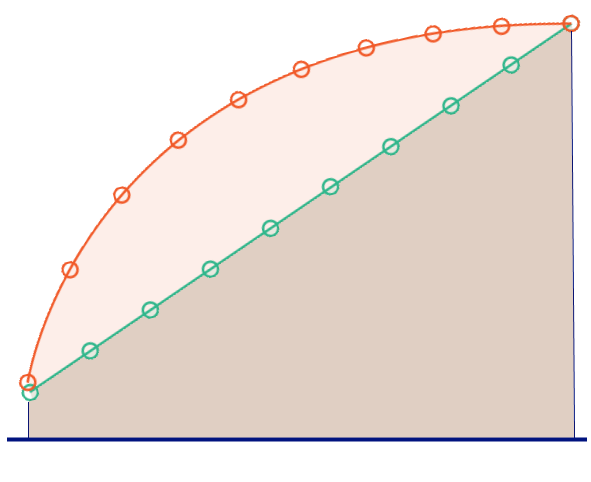

Your models are designed to answer questions, but the dynamics of your business always begs more questions. Create resilient models that simulate multiple outcomes and react to new input without starting over.

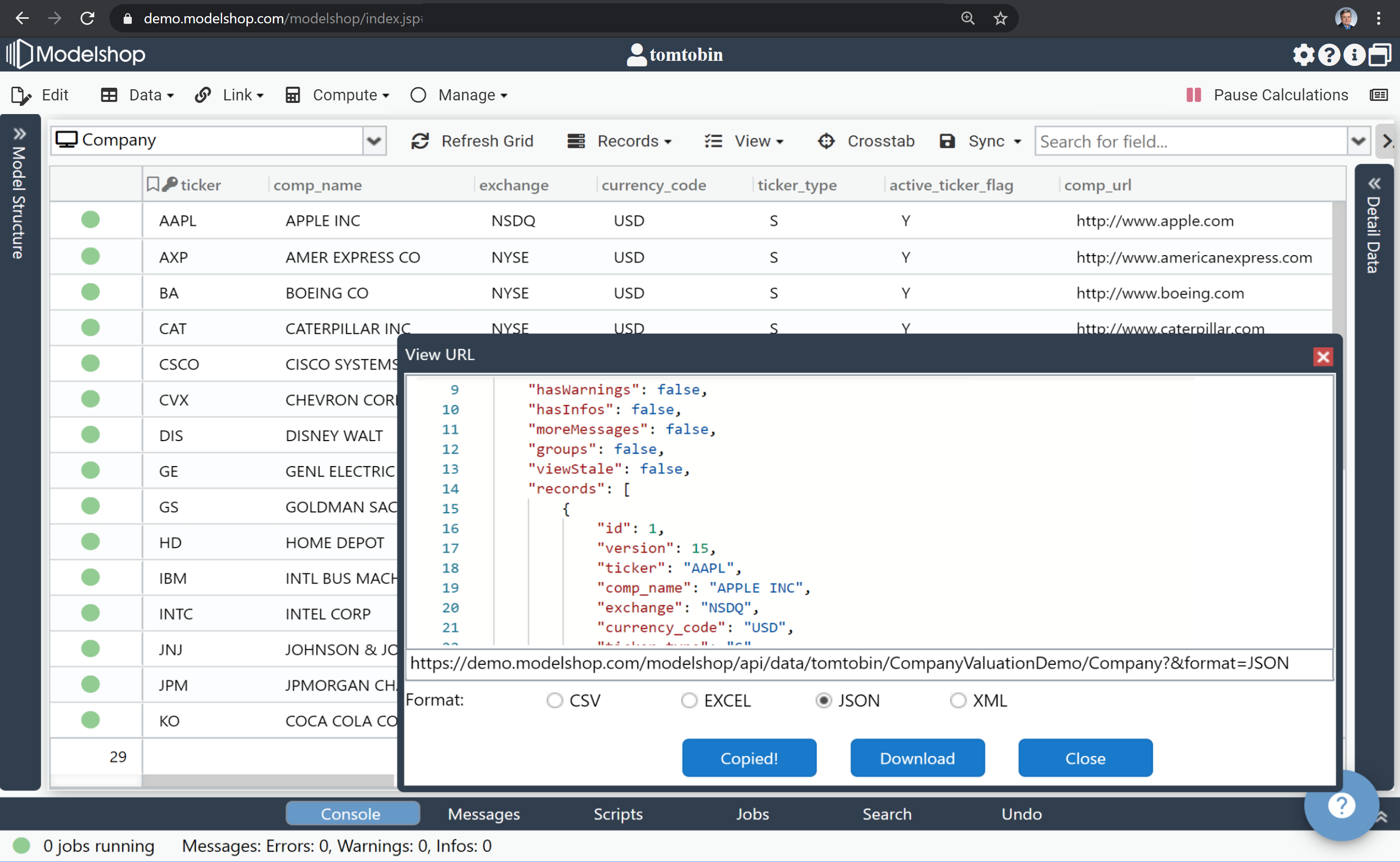

The days of waiting weeks or months to deploy a model to production are over. Modelshop models are ready to be deployed as scalable, real-time services the moment they are built. Skipping the coding step can accelerate new strategy deployment from weeks to minutes.

There's no faster way to train, optimize, and deploy machine learning algorithms in the cloud. Make your models smarter and get ahead of the game. All without a PhD. Seamless integration with existing machine learning tools.

You're busy. Let us show you how other teams have used Modelshop to build powerful, production-ready models or we can create a custom demo model using your data.

Create a trial account