There’s a lot of buzz around AI in banking. It’s fun, edgy and brainy. Emerging vendors claim all forms of AI from re-balancing your investment portfolio to interdicting fraud. While these solutions are real and add value, they are not Artificial Intelligence, they’re applied Machine Learning (ML). Machine Learning techniques are not new and have been critical to banking for decades. The FICO score has been the primary probability of default model in US consumer lending since 1989 and there were earlier models dating back to the 60’s and 70’s. Predictive algorithms have been used in insurance risk, automated trading and fraud prevention for almost as long. While the buzz is recent, the technology is mature.

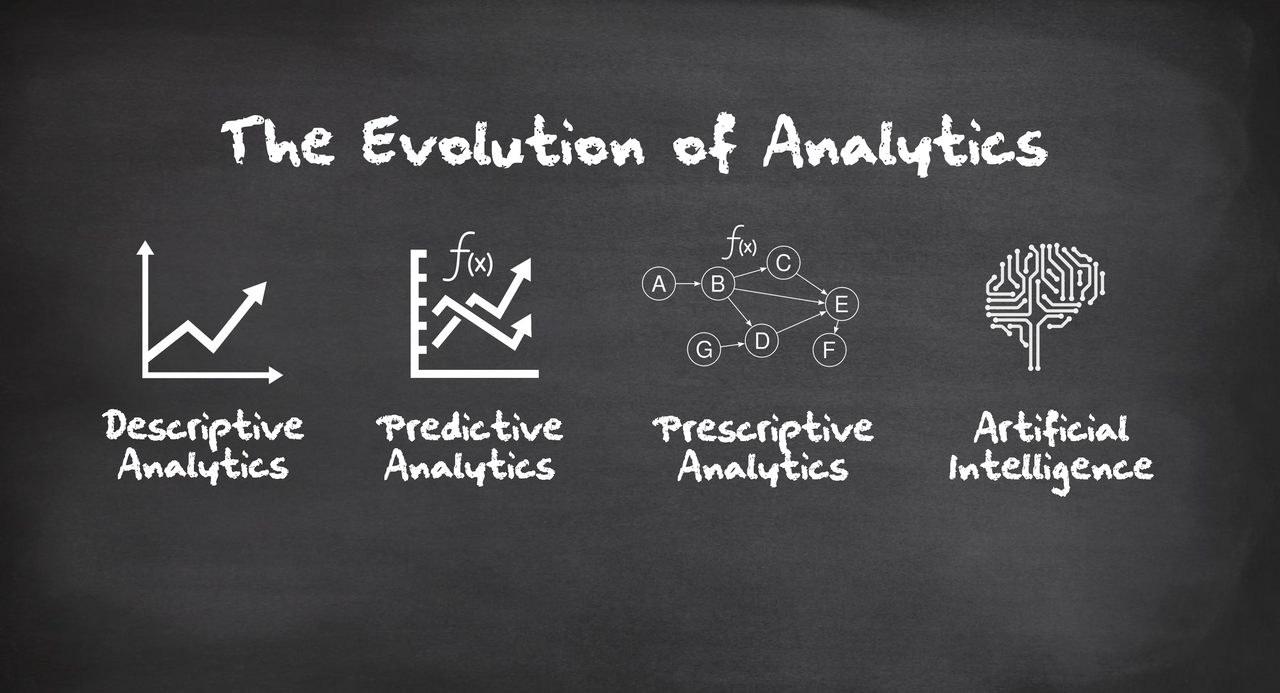

Interestingly, not only is Machine Learning (or Predictive Analytics) not Artificial Intelligence, it’s not even the direct precursor to AI. Simply explained, Machine Learning uses data from the past to learn how to predict future behavior or identify hidden patterns, typically by fitting a mathematical function across a large amount of historic observations. It’s a function that typically returns a simple probability or a match. Even deep learning algorithms used in applications like voice recognition and machine vision, while using more sophisticated math, are similar in objective – detecting patterns and scoring a probability of match (e.g. to identify a theme in a document or an object in front of a car).

Simply modeling patterns in data to project a future outcome is not Artificial Intelligence

Whether these pattern-matching techniques can be classified as Artificial Intelligence depends largely on your definition, but most agree that an AI system will ‘emulate or imitate human behavior’. Simply recognizing a pattern and projecting a future outcome is clearly not AI. I don’t know many humans who do this for a living. Predictive Analytics are often combined with decision systems that begin to come closer to an intelligent solution – applications such as fraud interdiction using Neural Networks can not only detect the probability of fraud but stop a transaction before money is lost. Anyone with a credit card is aware that the issuers have been doing this since the 90’s.

Gartner classifies this form of analytic system (combining predictions with predetermined prescriptive action) as Prescriptive Analytics. We’re getting closer to AI, and I’ve seen some very powerful prescriptive analytic solutions, but we’re not there yet. The main missing ingredient is independent goal directed actions. For example, if we could deploy an application that continually analyzed competitive markets and the economy and could automatically adjust your credit origination policy to optimize your portfolio return based on evolving macro-economic conditions – that would begin to feel like AI. A technology like that would effectively cut human intuition and strategy out of the loop. At that point we’re starting to fully automate what your staff are doing to run your business every day, and now it’s getting a bit more uncomfortable regarding human job security.

There is a tremendous body of human intelligence captured in the millions of spreadsheets used across industries.

Luckily for humans, I believe we are a decade away from this level of AI in banking. Why? Because we haven’t yet figured out how to effectively automate our Human Intelligence assets. Think about the tools most organizations use to do the business optimization described above (e.g. adjusting lending policies to maximize portfolio return). In most cases your teams are still using – you guessed it – spreadsheets. Possibly the least sexy technology in the bank, but in many ways the most flexible and powerful tool available to most business analysts. With spreadsheets, your analysts can work with almost any data source, create new calculations on the fly and project future performance without coding and without waiting for IT to build an application. Spreadsheets are empowering and widespread. If you consider the millions of spreadsheets in use across the financial services industry there is a tremendous amount of logic, insight, assumptions and intuition trapped in cells and macros.

Unfortunately, there is very little we can learn from this body of knowledge because the decades old technology it’s trapped in is unstructured, lacks transparency and is offline. Anyone who has tried to understand someone else’s enterprise class spreadsheet understands how obscure formula-based logic can be. Spreadsheets are disconnected, opaque, high-risk islands of human intelligence that happen to be running today’s financial services industry. They are the biggest barrier to centralizing and sharing the Human Intelligence that would serve as a critical model for a future generation of Artificial Intelligence. Until we solve the spreadsheet problem, most of our jobs are secure from AI automation.