Robotic Process Automation (or RPA) has become a rallying cry for organizations bogged down by expensive and repetitive manual processes. Automating manual, less creative work to free staff to focus on adding value (and let’s face it, to save money) is an alluring promise in particular for financial institutions as they face new competitors who are more agile and more connected to the next generation of consumers.

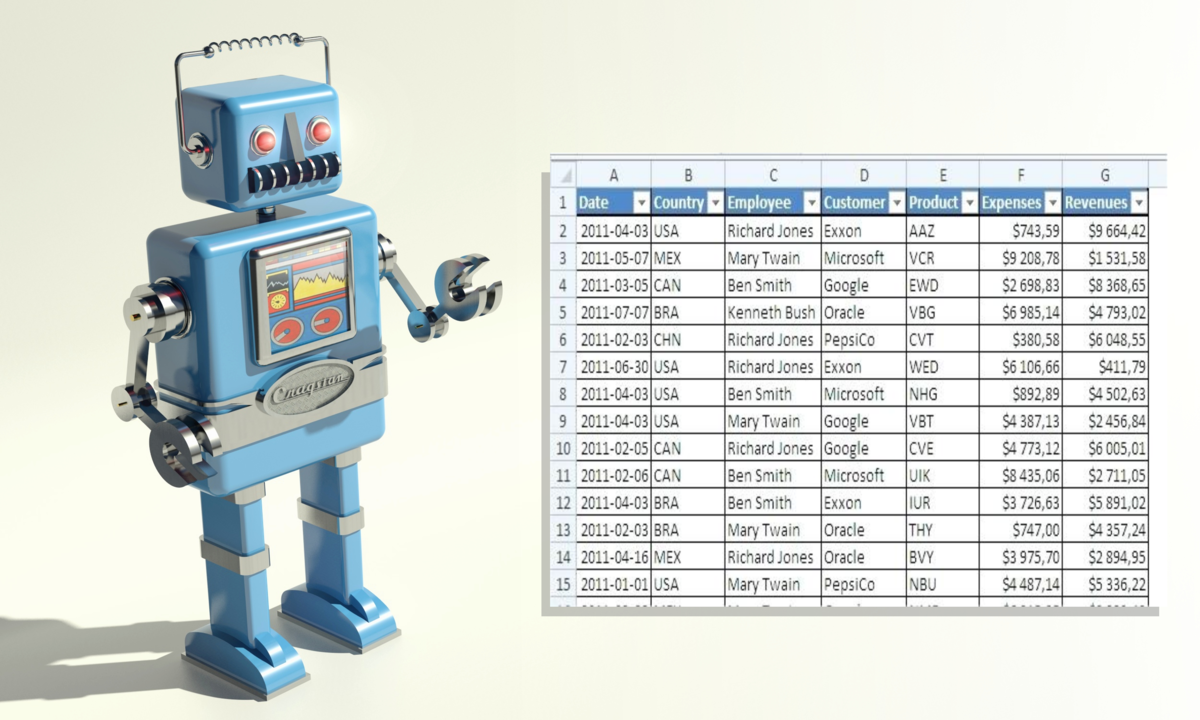

Based on conversations with a few teams implementing RPA, one of the challenges they encounter is handling the advanced spreadsheets that continue to dominate financial services. I’m not referring to simple workbooks that import data, do some pivots and dump results into the next step in the process. Those activities can either be automated with macros or easily converted to SQL, enabling more native automation. Instead I’m talking about more serious spreadsheets that do things like analyze asset liability risks across an organizational hierarchy or project and optimize ROE for a financial product line.

“It is not practical, or even desired, to fully automate analysis models as black-box process steps”

While these activities can benefit from automation, they present a couple of challenges. First, the sophistication of the analysis pushes these spreadsheets beyond the scope of macro tools. Varying assumptions, changing data structures and multi-step calculations make automation using spreadsheets unwieldy. Second, it’s not practical, or even desired, to automate these models as black-box process steps. The value your analysts provide to the business is their ability to see and feel the data, run scenarios, and interactively adjust their models until they have the answer that best reflects their expertise. Trying to fully automate this activity would miss the objective of your digital transformation.

I argue that today’s RPA tools can’t support automation for this level of enterprise spreadsheet use. That doesn’t mean, however, that these processes can’t be automated more than they are today. Emerging technologies like Modelshop make it possible to transform the logic in enterprise spreadsheets into online, API enabled applications. Once online, the knowledge from these financial models can now contribute to the organization’s digital transformation. Recurring pre-processing and data hygiene can be automated, accelerating access to insights. A Digital Analytics Association study found that analysts spend over 50% of their time preparing data and automation can dramatically reduce that effort. More importantly, the same business insights and calculations that powered your desktop projections can now be leveraged through APIs to automate real-time decisions across the enterprise. By connecting analysts directly to production data and systems, financial institutions can dramatically reduce the delay between creating insights into business performance and taking the actions that improve the bottom line.

There’s an unwritten rule that articles aren’t the place to plug a product, so I do apologize for the reference to my company. I am genuinely interested in starting a conversation. Many vendors promise an alternative to spreadsheets and historically all have fallen short. BI tools are great for rollups and charts, but that’s light-years away from running simulations and optimizing business strategies. Online grid and table alternatives, including Google Sheets, don’t have the computational power of Excel.

“Analysts claim you’ll need to pry Excel from their cold, dead hands – but digital transformation is coming, and we need a different solution”

Because spreadsheets are so empowering, there is a population of analysts who claim you’ll have to pry Excel from their cold, dead hands. At the same time, most of us realize that the spreadsheet party is coming to an end. The data modeling is horrible. The functional language is weak and hard to follow. Spreadsheets are hard to share and control. Most importantly, spreadsheets simply won’t scale with the explosion of data happening. IT knows this, but often choose to avoid the conversation because of the passion the business has for maintaining control of their analysis tools.

So what’s next? Some say that everyone will learn to code Python. I’ve been writing code since middle school – I know that it’s an arcane process that is suitable only for individuals who think differently than most. Code is not the answer and the big push for low-code platforms is the industries response to that reality. So where is the low-code solution that brings mission-critical business analysis into the digital transformation age? We believe we have a credible answer, but I’m curious what others think.