The End of “As Low As” Credit Offers

For decades, credit marketing has relied on a frustratingly vague model. We’ve all seen it: solicitations for “rates as low as 2.9%” or “limits up to $50,000.” Then, after going

For decades, credit marketing has relied on a frustratingly vague model. We’ve all seen it: solicitations for “rates as low as 2.9%” or “limits up to $50,000.” Then, after going

Alright, I admit it, that’s a clickbait headline. And given my network, I’m sure many of you are thinking about Large Language Models (LLMs) the right way. But I’ve talked

Fellow Credit Union Enthusiasts, I’m starting this newsletter to begin an honest, practical conversation about AI and credit unions. If you’re reading this, we’ve likely crossed paths in our shared

We’re proud to announce that Modelshop has successfully completed its SOC 2 Type II audit, a critical milestone that demonstrates our dedication to the highest standards of data security, availability,

Lending technology has come a long way in the last ten years. We’ve seen tools that automate underwriting, simplify applications, and use alternative data to refine credit scoring. It’s all

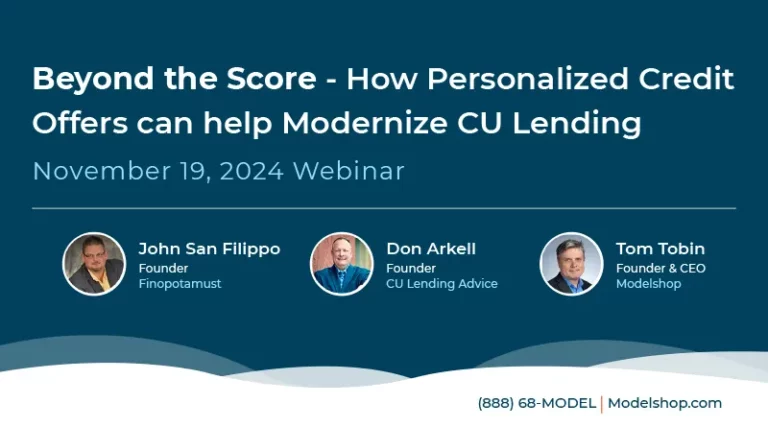

Attendee Takeaways: The urgent need for credit unions to evolve how they make decisions How current AI scores can negatively impact the member experience The definition of decision optimization and