Lending technology has come a long way in the last ten years. We’ve seen tools that automate underwriting, simplify applications, and use alternative data to refine credit scoring. It’s all impressive stuff.

But all these tools are doing is reacting.

A member applies, the system pulls data, and a decision is made. That’s the model.

Modelshop, on the other hand, is trying something different. Read on to learn how.

Modelshop’s Proactive Credit Offers

With traditional lending solutions, the member asks for a loan, and then the fintech does its magic. But Modelshop doesn’t wait for the members to apply.

Instead, Modelshop helps credit unions anticipate who needs what products – and why. It builds a rich picture of each member, using everything from traditional markers of creditworthiness to their broader financial situation. And that extra context changes everything.

Suddenly, you’re not just waiting around to see if someone qualifies. You’re spotting an opportunity, understanding the risk, and making the first move. Before the member starts shopping for a loan, you’ve already prepared a personalized one.

That shift from reactive to proactive lending is subtle, but powerful. By tapping into member data, cash flow modeling, and advanced analytics, Modelshop helps you understand your members instead of just scoring them.

Members Are People, Not Walking Credit Scores

Credit scores are helpful, but they only tell part of the story. The same could be said about newer AI risk models that, despite improved accuracy, are essentially better credit scores.

Both leave out a lot of critical info:

- What about potential income growth?

- What about job stability?

- What about lifestyle spending?

Those things don’t appear in a traditional credit model, but they matter.

This is one of the things that caught our attention with Modelshop. Two people with similar credit scores might be in very different places. One might be running out of cash and options, coasting on past financial success. Another might be leveraging debt to reach a more stable financial picture.

A traditional model would lend to the first person, but not to the second. Yet, using a cashflow model and a deeper understanding of the two borrowers, you’d learn that the second borrower is much lower risk.

Modelshop helps credit unions tell the difference.

If you want to know your members and not just score them, this is where you start.

Making the Offer, Not Just the Decision

The other thing that stands out about Modelshop is that it doesn’t wait for members to ask for a loan. It constantly analyzes data to see which members might benefit from an offer. That could be a refi on an old loan, a consolidation option, or a new product entirely.

Then, the system prepares a member offer, ready to deliver it through the channel that works best for the member, whether that’s an outbound message, a notification when they log into their member portal, or instantly presented when the member explores credit options.

This is proactive, not reactive. Reactive lending is a bottleneck on opportunity. Reactive means you only get applications from members who already know what they want and think they’ll get approved. Everyone else—members with needs, potential, and good long-term outlooks—gets left behind because they didn’t ask at the right time or didn’t know what to ask for.

Modelshop is proactive, delivering best-fit loan and credit options to members before they even start shopping around.

Let’s Talk Tech Stacks

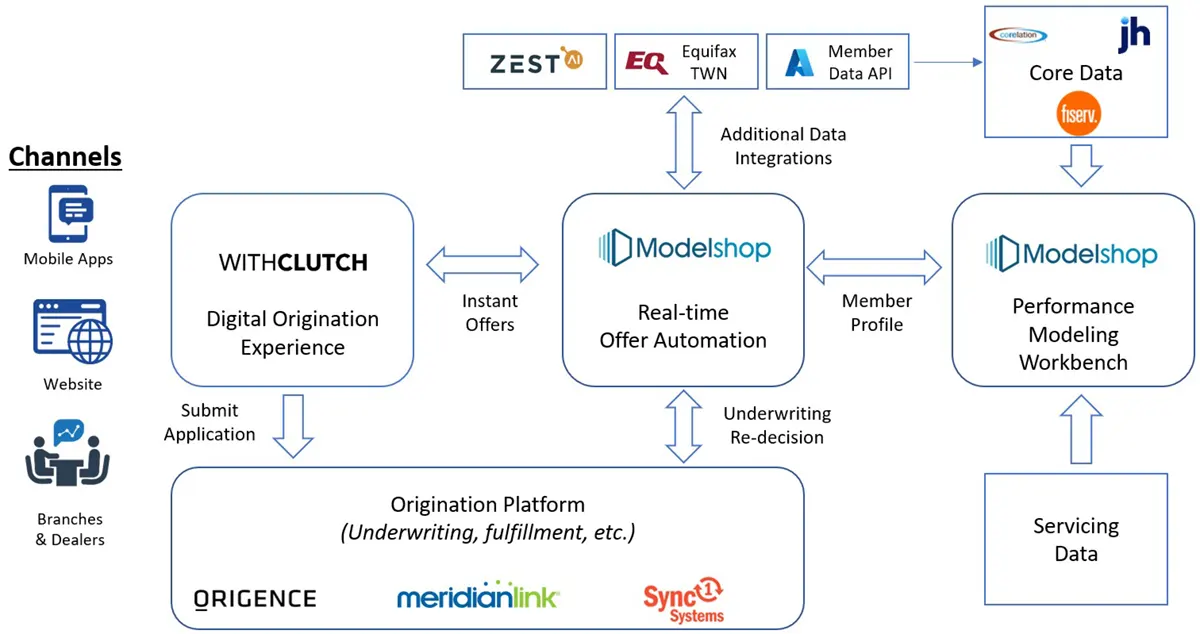

Modelshop fits into existing systems, so it doesn’t need to replace your current stack. Instead, it works alongside decisioning engines, origination platforms, CRMs, and core systems, helping them all work a little smarter.

It doesn’t demand a full system overhaul. It just makes what you already have more useful.

Modelshop isn’t a narrow, single-use product. It’s not “loan decisioning software” in the traditional sense, though it can be that if that’s what you’re after. But overall, it’s more like an intelligence layer that helps your other systems understand members better and act on that understanding in real time.

Learn More About Modelshop

Our two big takeaways after looking into Modelshop are:

- It helps credit unions understand their members instead of just scoring them, and

- It makes the offer, rather than just making the decision.

On a less formal note, Modelshop also addresses two major technology initiatives that we’ve seen credit unions struggle to make work: AI and data.

Modelshop uses both, and it does so without getting all hands on deck for a major data or AI project. We’re excited by the possibilities that Modelshop poses for credit unions (and by what they’ve accomplished so far with a big one in California—not sure if we have the go-ahead to use their name, but you’ve heard of it).

Learn more about how this is impacting credit unions. There is an interesting podcast here.